Accountancy and Auditing, Paper 1, CSS-2021

FEDERAL PUBLIC SERVICE COMMISSION

COMPETITIVE EXAMINATION-2021

FOR RECRUITMENT TO POSTS IN BS-17

UNDER THE FEDERAL GOVERNMENT

ACCOUNTANCY AND AUDITING, PAPER-I

TIME ALLOWED: THREE HOURS

PART-I(MCQS): MAXIMUM 30 MINUTES

PART-I (MCQS) MAXIMUM MARKS = 20

PART-II MAXIMUM MARKS = 80

NOTE:

- (i) Part-II is to be attempted on the separate Answer Book.

- (ii) Attempt ONLY FOUR questions from PART-II, by selecting TWO questions from EACH SECTION. ALL questions carry EQUAL marks.

- (iii) All the parts (if any) of each Question must be attempted at one place instead of at different places.

- (iv) Write Q. No. in the Answer Book in accordance with Q. No. in the Q.Paper.

- (v) No Page/Space be left blank between the answers. All the blank pages of Answer Book must be crossed.

- (vi) Extra attempt of any question or any part of the question will not be considered.

PART-II

SECTION-I

Q. No. 2.

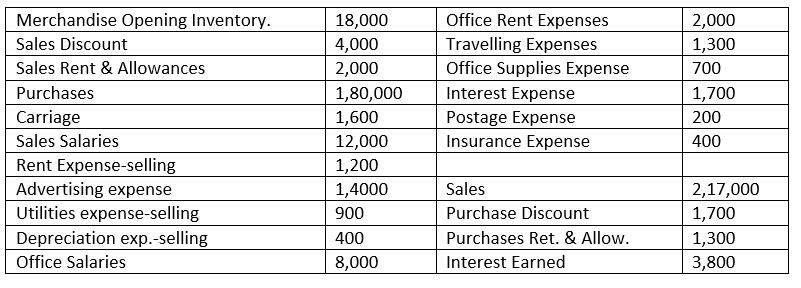

You are required to prepare Income Statement for the period ending 31st December, 2019: (20)

Question No. 2 table of Accountancy & Auditing, Paper-1, CSS-2021

Q. No. 3.

A, B are two partners sharing profits and losses in the ratio of 3:1. They admit K as a partner and he pays Rs. 30,000 as capital. The ratio is to be 3:1:1. The goodwill of the firm is to based on 3 years’ purchase of the average 4years’ profits which arc Rs. 15.000, 12,000, 18,000, 19,000.

Required:

Show the journal entries, if:

(A) K pays for the goodwill in cash.

(B) He is unable to bring the cash for the goodwill.

(10) (10) (20)

Q. No. 4.

XYZ purchased a delivery truck for the distribution of its finished products for Rs. 65.000 on 1st January, 2013. The expected useful life of that truck was five years and a salvage value of Rs. 5,000.

Required:

Calculate the following:

(A) The annual depreciation expense by applying sum of the year digit method. (10)

(B) Pass loomed entries and prepare depreciation schedule. Also state the assumptions of this method. (10)

(20)

SECTION-II

Q. No. 5.

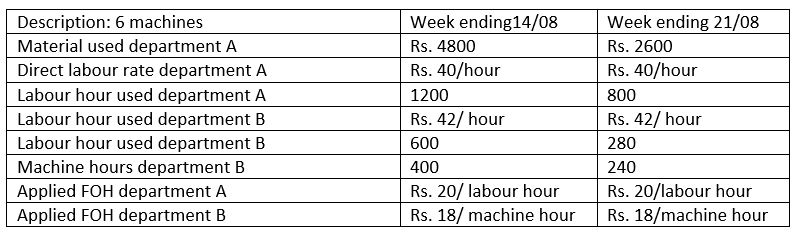

Attock Engineering Co. Ltd produces machines as per customer’s specifications. The following data pertains to job order no. 1122:

Question No. 5 table of Accountancy & Auditing, Paper-1, CSS-2021

Marketing and administrative costs arc charged to each order @ 20% of the cost to manufacture.

Required: Prepare job order cost sheet. Calculate sales price of the job, assuming that it has been contracted with a mark-up of 40% of cost. (20)

Q. No. 6.

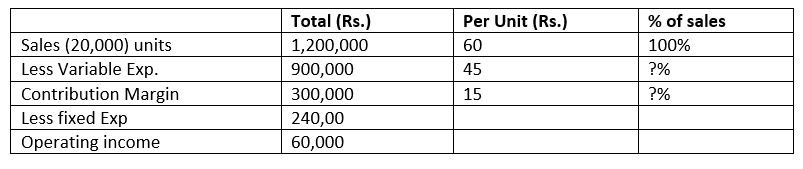

Volta company’s contribution format income statement for the recent year is given below:

Question No. 6 table of Accountancy & Auditing, Paper-1, CSS-2021

Management is anxious to improve the company’s profit performance and has asked you for an analysis of number of items.

Required:

(A) Compute the company’s CM ratio and variable expense ratio. (10)

(B) Compute the company’s breakeven point in both units and sales rupees. (10)

Q. No. 7.

Brooks Inc. uses process costing. The costs for Department 2 for April were:

Cost from preceding department Rs.20,00

Cost added by department:

Materials Rs: 21,816

Labor 7,776

FOH 4,104

The following information was obtained from the department’s quantity schedule:

Units received 5,000

Units transferred out 4,000

Units still in process 1,000

The degree of completion of the work in process as to costs originating in department 2 was:

50% of units were 40% complete; 20% were 30% complete; and the balance were 20% complete.

Required: The cost of production report for Department 2 for April.

(20)

Q. No. 8.

When setting its predetermined overhead application rate, Tasty Inc. estimated its overhead would be Rs.75,000 and manufacturing would require 25,000 machine hours in the next year. At the end of the year, it found that actual overhead was Rs.74,000 and manufacturing required 24,000 machine hours.

Required:

(A) Determine the predetermined overhead rate. (10)

(B) What is the overhead applied during the year? (10)

(20)

**********